"A surprise Democratic win in the House and Senate would likely weigh on equities, as market participants might expect additional corporate tax increases," Hatzius added. "The financial market reaction to a Republican win should be muted, as the House outcome is already widely expected, and the Senate outcome makes less of a difference to policy outcomes if Republicans control the House," Goldman Sachs' Jan Hatzius wrote in a Monday note. One wild card would be if multiple races that could determine control of Congress are too close to call, an outcome that could weigh on markets Wednesday. Overall, history shows markets tend to gain into year-end and up to 12 months following midterm elections as investors are relieved to get some clarity on future policy. The markets usually do very well when that happens," said The Wealth Alliance's Seth Cohan.

"If we have a gridlock, that will probably be the best thing that could happen for the market.

Investors tend to like the notion of gridlock in Washington with a divided Congress and president because it will limit government spending, new taxes and regulations. Market participants are expecting Republicans to take back the House of Representatives and possibly win the Senate as well when results start rolling in Tuesday night. All three indexes rallied for a third straight day. The Nasdaq Composite advanced 0.49% to 10,616.20. The Dow Jones Industrial Average gained 333.83 points, or 1.02%, to 33,160.83. midterm elections, which could affect future levels of government spending and regulation. Suppose the publisher was not profit-maximizing but was concerned with maximizing economic efficiency.Stocks rose Tuesday as investors awaited the results of the U.S.

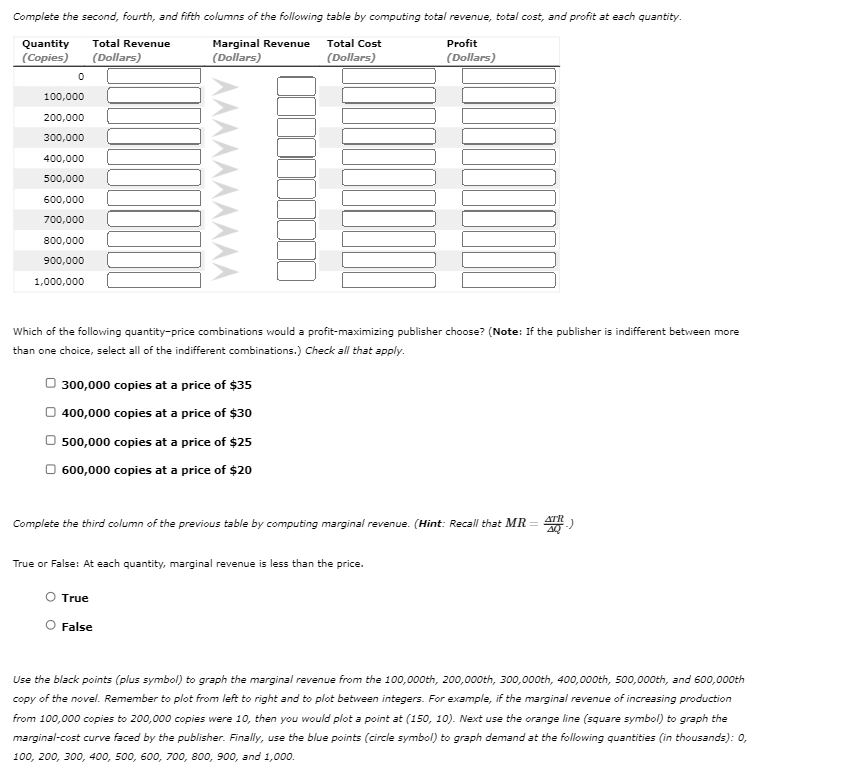

If the author were paid $3 million instead of $2 million to write the book, how would this affect the publisher’s decision regarding what price to charge? Explain.f. In your graph, shade in the deadweight loss. At what quantity do the marginal revenue and marginal-cost curves cross? What does this signify?d. Graph the marginal-revenue, marginal-cost, and demand curves. (Recall that MR = ΔTR/ΔQ.) How does marginal revenue compare to the price? Explain.c. What quantity would a profit maximizing publisher choose? What price would it charge?b. Compute total revenue, total cost, and profit at each quantity.

0 kommentar(er)

0 kommentar(er)